Empowering Businesses Through

Strategic Financial Support

Quick, Reliable, and Flexible Solutions Tailored to Your Needs

$1.2B

in new capital is projected to be allocated by the SBA and other private lenders in 2026 for small and medium-sized enterprises.

$5M

The maximum loan amount for an SBA 7(a) loan is $5 million, with the SBA's maximum exposure (guaranteed amount) up to $4 million in 2026

Tailored Lending Solutions to Meet Your Needs

We offer a range of flexible and accessible loan options designed to fit your unique financial goals. Whether for personal, business, or emergency needs, we’ve got you covered with simple and stress-free solutions.

About Us

Your Trusted Partner in Financial Growth

We’re committed to helping individuals and businesses achieve their financial goals. With personalized lending solutions, transparent processes, and a customer-first approach, we aim to provide the support you need to succeed.

Our Mission

We strive to empower our customers with accessible and flexible financial solutions. By prioritizing your needs and goals, we ensure every step of the lending process is straightforward, transparent, and tailored to you.

Why Choose Us

With years of industry experience, a dedicated team, and a focus on trust, we stand out as your dependable financial partner. From competitive rates to quick approvals, we work hard to make lending stress-free and accessible for all.

Our Commitment

Your success is our priority. We are dedicated to delivering exceptional customer service, innovative solutions, and a secure lending experience you can rely on for every stage of life.

Resources to Support Business Success

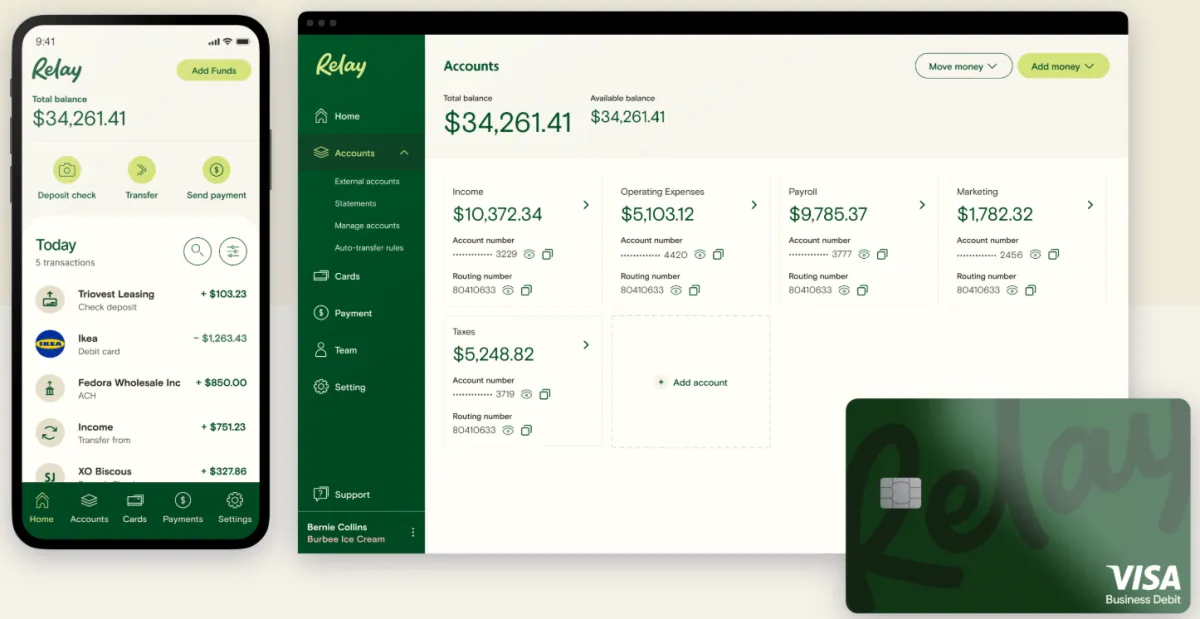

No Fee, Multi-Account, Cashflow System

Resources to Support Business Success

Financial Solutions

Empowering Your Financial Journey Through Smarter Solutions

At CBC Capital Partners, we provide smart solutions to help you achieve your financial goals. With expert guidance and tailored options, we ensure you make informed decisions every step of the way.

Relay Bank offers no monthly fees, up to 20 checking accounts, Profit First features, automated savings, and seamless integrations with QuickBooks, Xero, and Gusto. It’s the ideal solution for business owners seeking smarter cash flow, control, and financial clarity.

Why Choose Us

Building Innovative Lending Solutions for Financial Success

Our experienced professionals craft personalized lending strategies to meet your financial aspirations. We emphasize transparency, reliability, and tailored solutions to ensure a seamless journey toward achieving your goals.

Trusted Expertise

Our team of seasoned lending specialists ensures a smooth, efficient process by offering expert guidance tailored to your financial needs.

Cash Flow Optimization

Streamline your cash flow with structured banking efficiencies and effective financial planning, ensuring long-term stability and growth.

Accountability in Action

Stay on top of your financial goals with proactive check-ins, consistent support, and personalized assistance throughout your lending journey.

Our Expertise

Transforming Financial Success with Expertise and Personalized Lending Solutions

Our team of specialists is dedicated to empowering individuals and businesses with tailored lending solutions that address unique financial goals. By providing innovative strategies, we aim to simplify complex financial processes and ensure sustainable growth and stability for our clients.

Advantages of Choosing Our Services

Experience a new level of financial flexibility and support with our personalized lending services. Whether you aim to grow your business, secure your future, or manage risks, our expertise ensures that your journey is smooth, efficient, and rewarding.

Customized Funding Plans

Simplified Approval Processes

Qualification Support Process

Unique Funding Strategies

Business Solutions

Powerful Business Solutions, Backed by Trusted Partners

Frequently Asked Questions

Common Business & Finance

Questions And Answers

What is the interest rate for loans?

Interest rates vary depending on the type of loan, your credit profile, and market conditions. We strive to connect the most competitive rates while ensuring that the terms are fair and affordable. Our loan consultants will walk you through the different interest rate options available to you, allowing you to make an informed decision. Additionally, we offer flexible repayment terms to suit your financial situation.

How do I know if I qualify for a loan?

Qualifying for a loan depends on several factors, including your credit history, income, and the type of loan you are applying for. At CBC Capital Partners, we make the qualification process simple and transparent. Our team will evaluate your financial situation and provide guidance on the necessary documentation. If needed, we will work with you to improve your credit profile or financial standing,

How long does it take to receive loan approval?

The approval time for loans at CBC Capital Partners typically ranges from a few business days to a couple of weeks, depending on the complexity of the loan and the documents required. We prioritize quick processing without compromising on thorough evaluations. Once you submit your application and necessary documentation, our team works efficiently to review and approve your loan.

Quick Links

Contact Us

Legal

© CBC Capital Partners 2026 All Rights Reserved.